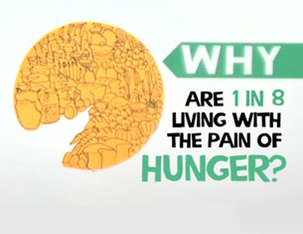

Izzy Braithwaite A few weeks ago, I went to an Enough Food IF training day, organised by a number of the big organisations behind the campaign. It aimed to give us the background needed to visit our MPs to talk about two of the main asks – aid and tax – in advance of the Budget and the Finance Bill. The question the IF campaign asks is ‘IF we produce enough food to feed everyone, why do one in 8 people go hungry?’ The crux of the argument is that IF we can change a number of key things about our current system, we can make sure everyone gets enough to eat. I couldn't really argue with that, and I decided I wanted to meet my MP about it - which I did as part of a group on Friday afternoon, and really enjoyed. How is the campaign linked to climate and health? I’ve been interested in global health for several years, focusing more recently on how climate change affects, and will affect, global health, which is how I got involved in Healthy Planet. It seems to me that one of the big impacts climate change is having on people in the poorest countries – and one of the biggest effects it’s likely to have on health in the future - is through food. It makes a lot of sense to me that IF we can build a fairer food system, including through changes in the way tax works for developing countries, that will help reduce the impact of climate-induced crop losses on the health of the poorest. Although the Enough Food IF campaign doesn’t focus explicitly on climate change, there’s a fair amount of evidence that land grabs, food price speculation and short-sighted biofuels policies – all of which the campaign aims to highlight and tackle – act alongside more unstable weather and inadequate social security to push more people into food insecurity. But even if it weren’t for climate change, we have massive injustices around food and access to it; climate change just exacerbates them. You can't really disagree that a world in which almost a billion who don’t have enough to eat while so many others throw away as much as they do, and while so many people are suffering the health effects of obesity, is kind of crazy. Tax and development I didn’t know a lot about the ins and outs of tax policy and how it related to international development before getting involved in the IF campaign, but came away from the training day and my reading online afterwards with a better understanding. I learnt how crucial tax revenue is in enabling developing countries to finance public services, and had no idea that tax avoidance currently costs them to the tune of 3 times as much revenue as they receive in aid each year. I was shocked to learn how Associated British Foods, which produces vast quantities of sugar in Zambia – a country where many people struggle to afford enough to eat – has managed to ensure that it pays less tax in Zambia than the woman in this ActionAid video, a shopkeeper who sells their sugar. Then there was the story about the Rwandan revenue authority, set up with a grant of £24 million from DfID, which now generates that much in tax every 3 weeks. Talk about value for money. That revenue stability enables the Rwandan government to finance essential public services like schools and healthcare, and helps it to ensure that it’s people have enough to eat. If we want aid to be effective and countries to be able to finance aspirations like Universal Health Coverage, tax should be a global health priority, and it was great to have some real examples to illustrate that at the meeting.  The meeting Alison Marshall, who works at Unicef UK and had signed up as a coordinator for my borough on the online lobbying forum, managed to set up a meeting with my MP Jeremy Corbyn for yesterday afternoon, and put everyone who’d expressed an interest in touch with the other interested people in Islington North. About half of those on the email list were able to make it, with quite a range of ages, jobs and backgrounds. Most of us had never met one another before the meeting, so we divided up tasks and subjects in advance and turned up for a chat half an hour before. Unforeseen circumstances meant the office was unavailable that day so we had to relocate, but fortunately an incredible woman called Theresa had offered up the nearby Finsbury Park Community Centre for the meeting. She filled us in on what things are like in the ward, which is one of the most deprived in England, and it was sobering to hear some of the statistics and stories. I'd read a bit about Mr Corbyn’s voting record and past involvement in international development-related work, so I had thought he would probably be happy to support the 0.7% aid goal, but I hadn’t known how he’d respond to the ask on tax transparency, which is a relatively technical one and took more explaining. It relates to the upcoming Finance Bill, and specifically asks that it extends DOTAS (disclosure of tax avoidance schemes) rules to any which impact on developing countries, in order to help them tackle tax avoidance by multinational corporations operating in their countries. The DOTAS regulations help tackle corporate tax avoidance in the UK, and it essentially requires companies to disclose any schemes they use to get out of paying tax. The IF ask (briefing here) is to introduce a similar requirement for UK companies and wealthy individuals to report their use of tax schemes with an impact on developing countries. It also asks that the bill require that when such schemes are identified the UK will use its existing powers under bilateral and multilateral treaties to notify developing countries’ tax authorities, and to assist in the recovery of that tax. Of course, transparency doesn’t in itself prevent tax avoidance, but it does make it much easier to hold companies accountable, and helps to enable developing countries to enforce and improve their laws. And of course UK action is not the whole of the answer – that will include international cooperation, which hopefully the G8 will make progress on, and country-by country reporting amongst other things. But it would be a good step on the road towards a fairer and more effective tax system, and could potentially set a useful precedent for other countries, and the EU, to follow. I quite like a challenge, so I’d kind of hoped we’d have to argue our case a bit more, but in fact he was very much in agreement with both of our asks, and agreed to write to the Chancellor and to lobby other Labour MPs and to raise it after the Budget and the Finance Bill. I suppose I can hardly complain that I have an MP who cares about international development and takes an interest in the details of how we should contribute to it even though most of his time is spent dealing with much more local issues. He told us about some of the problems he'd been trying to fix recently, such as the story of a guy who’d been sleeping on a bus for months who he’d just spent the afternoon trying to get re-housed. I hadn’t really thought there would be many parallels between politics and medicine before the meeting - not least because doctors tend to be trusted by the public whereas many politicians aren’t - but if I'd had to guess his job without knowing, I could easily have guessed a doctor or an overworked social worker. Both are both more of a lifestyle choice than a nine-to-five job, and both doctors and politicians have the opportunity to change peoples’ lives for the better.  Now is when the real test for the campaign begins - making sure there's enough pressure, and enough other MPs on board - to push through specific reforms. Which is where you come in... How can you get involved?

1 Comment

|

Details

Archives

February 2019

Tags

All

|

RSS Feed

RSS Feed